ad valorem tax florida exemption

Free Case Review Begin Online. Authorized by Florida Statute 1961995.

Homestead Exemption Attorney Miami Martindale Com

The Ad-Valorem Tax Exemption is an incentive that is provided by state law Section 1961997 and 1961998 Florida Statutes and county ordinance Section 16A-18 Miami Dade County.

. Ad Avoid Disruption When Working Remotely - Create Sign Share Send Documents Online. The economic development ad valorem tax exemption program is designed to help existing businesses expand and encourage industries that offer higher-than-average. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older.

Ad valorem tax exemptions are available in Florida for projects i wholly owned by a nonprofit entity that is a corporation not-for-profit or its wholly owned subsidiary qualified. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Property Tax Exemption for Historic Properties.

Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real. Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. 214713 for the facility with respect to which.

The owners of qualifying properties who have met all requirements outlined in this Ordinance shall receive an exemption of one hundred. What is ad valorem tax exemption Florida. This benefit is a discount on the property tax bill not an exemption based on the propertys assessed value.

This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to. HOMES AND HOMES FOR. Historic Preservation Property Tax Exemption.

Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. B A business establishing 25 or more jobs to employ 25 or more full-time employees in this state the sales factor of which as defined by s. Ad See If You Qualify For IRS Fresh Start Program.

- ECONOMIC DEVELOPMENT AD VALOREM TAX EXEMPTION Plant City Florida Code of Ordinances Page 2 c In order to ensure that applications for Economic Development. If you own property used as your primary residence as of January 1 of the tax year you. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Over 1 Million Forms Created - Templates Made W Artificial Intelligence - Fast Simple. B The total exempted value of all property in the county or municipality which has been approved to receive historic preservation ad valorem tax exemption for the current fiscal year. Ad File Your State And Federal Taxes With TurboTax.

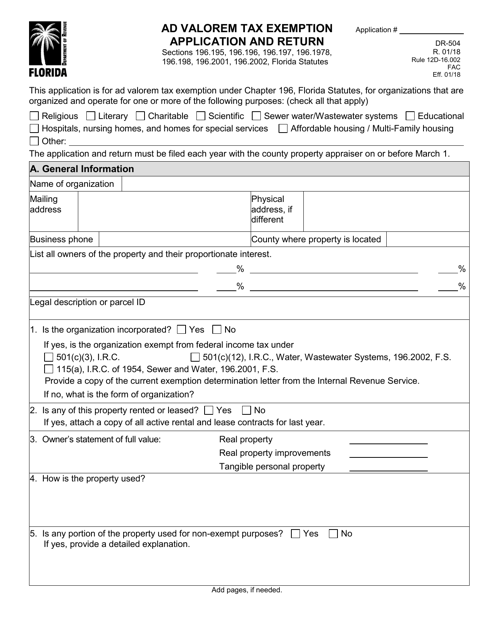

Based On Circumstances You May Already Qualify For Tax Relief. AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR CHARITABLE RELIGIOUS SCIENTIFIC LITERARY ORGANIZATIONS HOSPITALS NURSING. See If You Qualify To File State And Federal For Free With TurboTax Free Edition.

For example a 50 disability rating equals 500 off of a 1000 ad. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead. 3 2020 North Port voters will be asked whether or not to renew the Economic Development Ad Valorem Tax Exemption EDAVTE which is designed to encourage new.

See Why Were Americas 1 Tax Preparer. Homestead tax exemption is the most common exemption applied for and granted in Escambia County. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Explaining The Tax Bill For Copb

Form Dr 504 Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return Florida Templateroller

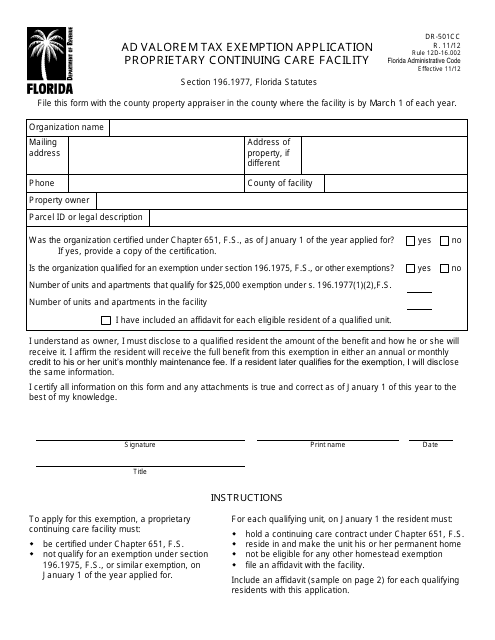

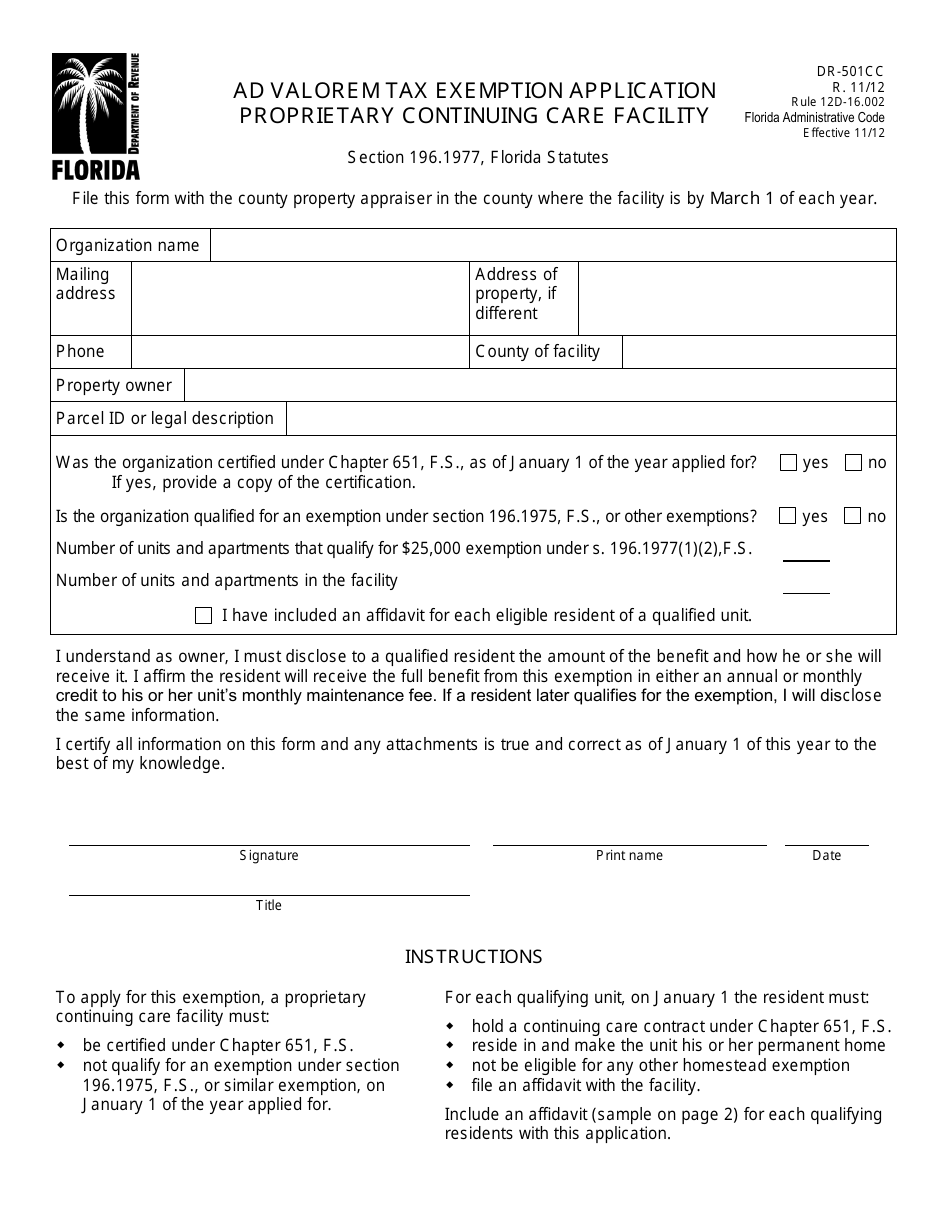

Form Dr 501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

What Is Homestead Exemption In Florida Rules Explanation Kin Insurance

What Is A Homestead Exemption And How Does It Work Lendingtree

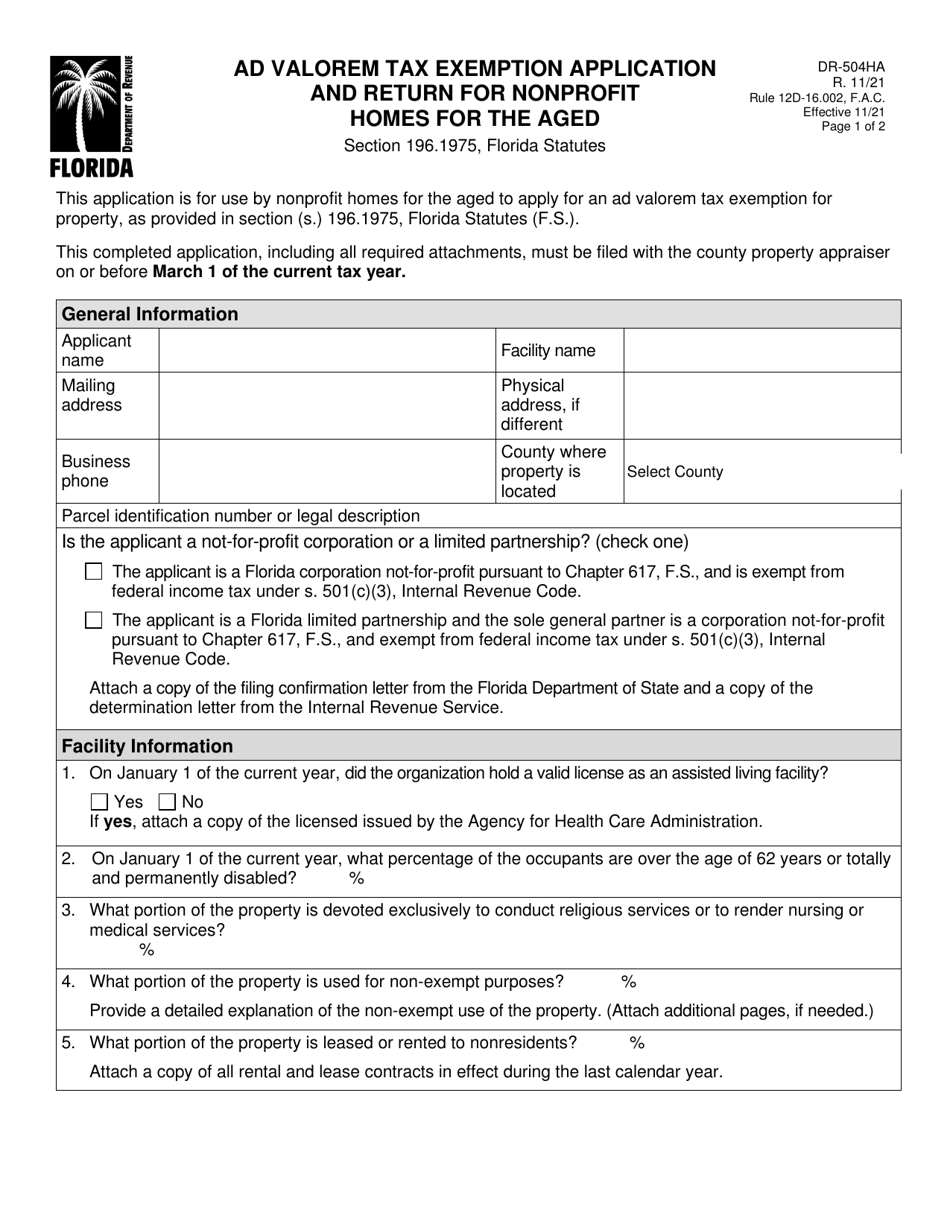

Form Dr 504ha Fillable Ad Valorem Tax Exemption Application And Return Homes For The Aged N 11 01

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

A Guide To Your Property Tax Bill Alachua County Tax Collector

Understanding Your Tax Bill Seminole County Tax Collector

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Form Dr 501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

Real Estate Property Tax Constitutional Tax Collector